Understanding Health Insurance for Business Owners

Running a business involves a range of responsibilities, one of which is ensuring both yourself and your employees have access to adequate health insurance. As a business owner, health insurance is not just a personal need—it’s also a crucial tool to attract and retain quality employees.

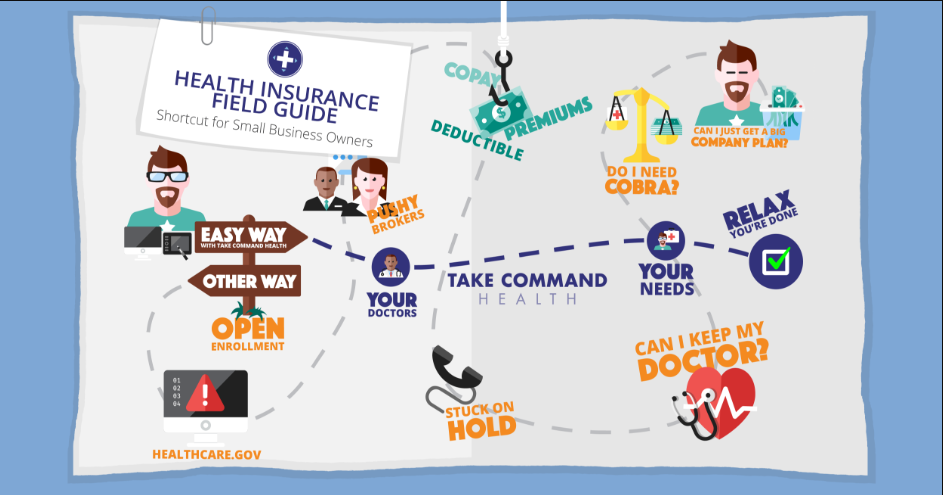

Insert image of health insurance plan document

Health insurance plans vary widely, from individual coverage options for solo entrepreneurs to group policies designed for businesses with multiple employees. Choosing the right policy can seem overwhelming, but understanding the available options and the specific needs of your business is key to making an informed decision.

Why Health Insurance is Essential for Business Owners

Business owners often overlook the importance of securing health insurance for themselves and their staff. Not only does it ensure financial protection against unexpected medical expenses, but it also improves employee satisfaction and loyalty.

Insert image of a happy business owner reviewing insurance options

When employees feel secure about their health coverage, they’re more likely to stay with the company long-term. This translates into lower turnover rates and a more committed workforce. Additionally, health insurance is often seen as a valuable benefit that can help you stand out as an employer in a competitive job market.

Top Health Insurance Plans for Business Owners

Below are five real-world examples of top-rated health insurance providers that cater to business owners, ranging from solo entrepreneurs to larger enterprises.

1. Blue Cross Blue Shield

Insert image of the product

a href=”https://www.bcbs.com“ Blue Cross Blue Shield Health Insurance /a

Blue Cross Blue Shield is known for its comprehensive coverage and extensive provider network. Whether you’re a solo business owner or managing a small team, their flexible plans cater to different business sizes and needs.

- Pros: Wide network of healthcare providers, customizable plans, wellness programs included

- Cons: Can be more expensive for smaller businesses, complex policy options

- Price: Starts from $300/month depending on coverage

- Features: Preventive care, prescription drug coverage, mental health services

- Use Case: Ideal for businesses seeking flexible plans that cater to both small and larger teams, with an emphasis on comprehensive care.

2. UnitedHealthcare

Insert image of the product

a href=”https://www.uhc.com“ UnitedHealthcare Small Business Insurance /a

UnitedHealthcare offers tailored solutions for businesses of all sizes, making it easy for business owners to choose coverage that suits their workforce. Their innovative digital tools make managing health benefits simple and efficient.

- Pros: Digital tools for easy plan management, diverse plan options, strong preventive care benefits

- Cons: Higher premiums for more comprehensive plans

- Price: Starts at $400/month depending on the size of the business

- Features: Telehealth services, preventive care, coverage for chronic conditions

- Use Case: Suitable for businesses that need digital access and flexible options for employee wellness.

3. Aetna

Insert image of the product

a href=”https://www.aetna.com“ Aetna Business Health Plans /a

Aetna offers health insurance plans that are especially appealing to small business owners due to their affordable pricing and broad coverage options. Their plans can easily be scaled up as your business grows.

- Pros: Affordable premiums, easy to scale, broad coverage options

- Cons: Limited availability in some states

- Price: Starting from $250/month for small businesses

- Features: Preventive care, access to wellness programs, online tools for plan management

- Use Case: Best for small businesses looking for affordable, scalable health insurance options.

4. Humana

Insert image of the product

a href=”https://www.humana.com“ Humana Group Health Insurance /a

Humana provides small to mid-sized businesses with competitive health insurance plans that include excellent wellness programs. Their group health insurance packages are designed to enhance employee satisfaction while keeping costs manageable for the business.

- Pros: Excellent wellness programs, competitive pricing, dental and vision add-ons available

- Cons: Limited to businesses with at least two employees

- Price: From $350/month depending on the business size and location

- Features: Wellness initiatives, preventive care, dental and vision add-ons

- Use Case: Ideal for business owners with at least two employees who want a strong focus on wellness.

5. Cigna

Insert image of the product

a href=”https://www.cigna.com“ Cigna Health Insurance for Businesses /a

Cigna is known for its global coverage options, which makes it an excellent choice for businesses that have employees traveling abroad or living in multiple states. Their plans are flexible and come with a range of coverage options.

- Pros: Global coverage, strong customer service, telehealth services

- Cons: Can be expensive for smaller businesses

- Price: Starting at $450/month depending on the plan

- Features: Global health coverage, telehealth services, preventive care

- Use Case: Best for business owners with international or multi-state employees who need comprehensive coverage.

Benefits of Providing Health Insurance for Your Business

Health insurance for business owners offers numerous benefits beyond basic coverage. Some of these include:

- Increased Employee Retention: Employees are more likely to stay with companies that offer competitive health benefits, reducing turnover.

- Tax Benefits: Employers can deduct health insurance premiums from their taxes, which can reduce overall business expenses.

- Attract Better Talent: Offering health insurance as a benefit can make your business more attractive to skilled workers, giving you an edge in hiring.

How to Choose the Best Health Insurance for Your Business

Selecting the right health insurance depends on your business size, budget, and employee needs. Consider the following when evaluating plans:

- Coverage Flexibility: Look for a plan that offers flexibility in coverage options to ensure it meets the varied needs of your employees.

- Cost vs. Benefits: While cheaper plans might be tempting, weigh the benefits they offer to ensure they cover essential healthcare services.

- Provider Network: A wider network of doctors and hospitals ensures that your employees have access to quality care.

How to Buy Health Insurance for Your Business

When you’re ready to purchase health insurance, consider the following steps:

- Research Providers: Use comparison websites to research and compare different insurance plans.

- Get a Quote: Most health insurance providers offer online quotes based on your business size, location, and coverage needs.

- Purchase Online or via Broker: Many providers allow you to purchase health insurance online, or you can work with an insurance broker for personalized assistance.

Insert button: Get a Quote for Health Insurance

FAQs

1. What is the best health insurance for small businesses?

The best health insurance depends on your business’s needs, but companies like Blue Cross Blue Shield and Aetna are known for their affordable and flexible plans for small businesses.

2. How much does business health insurance cost?

Costs vary based on the size of the business and coverage options. On average, health insurance for small businesses can range from $250 to $500 per month per employee.

3. Is health insurance tax-deductible for business owners?

Yes, in many cases, health insurance premiums paid by business owners are tax-deductible, reducing overall business expenses.