Small business insurance provides essential protection against unforeseen events that could jeopardize your business’s operations and finances. This coverage is designed to mitigate risks associated with property damage, legal liabilities, employee injuries, and more.

One of the primary reasons for obtaining small business insurance is to safeguard your financial investment. For many entrepreneurs, their business represents a significant portion of their personal assets. In the event of a lawsuit or a natural disaster, having the right insurance can mean the difference between recovery and financial ruin.

Moreover, certain types of insurance are often legally required, depending on your industry and location. For example, if you have employees, workers’ compensation insurance is typically mandatory. This requirement ensures that your business complies with legal standards while protecting your employees and your bottom line.

Types of Small Business Insurance

General Liability Insurance

General liability insurance is one of the most fundamental types of coverage every small business should consider. It protects against claims of bodily injury, property damage, and personal injury resulting from your business operations.

For instance, if a customer slips and falls in your store, general liability insurance can help cover the medical expenses and legal fees that may arise from the incident. This coverage not only shields your finances but also enhances your business’s credibility, reassuring clients and partners that you are prepared for potential risks.

Additionally, many clients and partners prefer working with businesses that carry general liability insurance. It demonstrates professionalism and a commitment to risk management, making your business more appealing in competitive markets.

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, is crucial for businesses that provide professional services or advice. This coverage protects against claims of negligence, errors, or omissions that may occur during the course of providing your services.

For example, a consulting firm could face a lawsuit if a client alleges that the advice given led to financial losses. Professional liability insurance would cover legal costs, settlements, or judgments, allowing the business to continue operating without severe financial repercussions.

This insurance type is particularly relevant for professions such as accounting, legal services, and medical practices, where the stakes of professional errors are high.

Workers’ Compensation Insurance

Workers’ compensation insurance is designed to protect employees who may suffer injuries or illnesses related to their work. In the event of an accident, this insurance covers medical expenses, lost wages, and rehabilitation costs, while also protecting your business from potential lawsuits.

The importance of this insurance cannot be overstated; it ensures that your employees receive the necessary care while minimizing the financial impact on your business. In many jurisdictions, carrying workers’ compensation insurance is a legal requirement, further emphasizing its importance in maintaining compliance and ethical standards in the workplace.

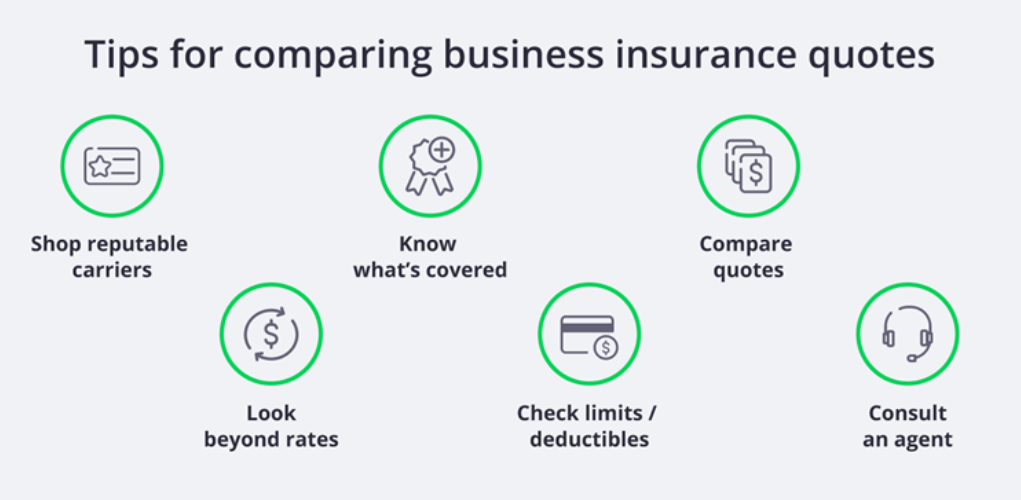

Comparing Insurance Providers

When selecting an insurance provider, it’s essential to compare coverage options, premiums, and customer service ratings. Researching multiple providers allows you to identify the best fit for your business needs.

Key Factors to Consider

- Coverage Limits: Ensure that the insurance provider offers adequate coverage limits that align with your business’s size and risk exposure. This factor is crucial for safeguarding against potential claims that could exceed your coverage.

- Premium Costs: Compare premiums across different providers, keeping in mind that the cheapest option may not always offer the best coverage. Evaluate the value of the coverage in relation to the premium to ensure a balanced decision.

- Customer Reviews: Investigate customer feedback and reviews to gauge the quality of service and claims handling of various insurance providers. A company with a strong reputation for customer service can make a significant difference during stressful claims processes.

Real-World Product Examples

- Hiscox General Liability Insurance

- Coverage: Provides comprehensive general liability coverage for small businesses.

- Pros: Flexible policies tailored to specific industries, excellent customer service.

- Cons: Premiums can be higher for high-risk industries.

- Price: Average annual premium of $500-$1,000.

- Visit Hiscox

- Next Insurance Professional Liability

- Coverage: Errors and omissions insurance tailored for small business professionals.

- Pros: Affordable rates and easy online management.

- Cons: Limited coverage for complex claims.

- Price: Average annual premium of $400-$800.

- Visit Next Insurance

- State Farm Workers’ Compensation

- Coverage: Comprehensive workers’ compensation insurance for various industries.

- Pros: Extensive network of agents and local support.

- Cons: Claims process can be lengthy.

- Price: Average annual premium varies based on industry risk.

- Visit State Farm

Benefits of Small Business Insurance

Investing in small business insurance provides numerous benefits that can contribute to your long-term success. Here are a few key advantages:

Financial Protection

The most apparent benefit of having insurance is financial protection. In the event of unexpected events, such as accidents or lawsuits, insurance can help cover costs that could otherwise devastate your business’s finances. This safety net allows you to focus on growth and operational efficiency rather than worrying about potential liabilities.

Peace of Mind

With the right insurance coverage in place, business owners can operate with greater peace of mind. Knowing that you are protected against unforeseen circumstances can reduce stress and allow you to concentrate on your core business activities.

Business Credibility

Carrying adequate insurance enhances your business’s credibility with clients, suppliers, and partners. It demonstrates that you take risk management seriously and are committed to maintaining a secure and trustworthy operation. This perception can lead to increased business opportunities and partnerships.

Conclusion

In summary, understanding and comparing small business insurance options is crucial for any business owner looking to protect their investment and ensure long-term success. By taking the time to research and assess different policies and providers, you can find the right coverage that meets your business needs.

Remember, the right insurance is not just a safety net but a strategic investment that can enhance your business’s credibility and resilience. Take action today by exploring your options and securing your business’s future.

FAQs

- What is small business insurance? Small business insurance is a type of coverage designed to protect businesses from various risks, including property damage, liability claims, and employee injuries.

- Is small business insurance mandatory? While not all types of insurance are legally required, certain coverage, like workers’ compensation, is mandatory in many jurisdictions.

- How do I choose the right insurance provider? Compare coverage options, premiums, customer service ratings, and reviews to find an insurance provider that fits your business needs.

- Can I customize my insurance policy? Yes, many insurance providers offer customizable policies that allow you to tailor coverage to your specific business risks.

- What are the average costs for small business insurance? Costs vary significantly based on industry, coverage needs, and business size. Generally, small businesses can expect to pay between $500 and $2,000 annually for general liability insurance.