Introduction:

Small businesses that rely on vehicles for daily operations face unique risks. Commercial auto insurance is essential to protect your business from financial liabilities that may arise from accidents, theft, or damage. Finding affordable and reliable commercial auto insurance rates for small businesses can be challenging, but this guide will provide insight into top options, their benefits, and how to secure the best rates.

Why Commercial Auto Insurance is Essential for Small Businesses

Running a small business often involves the use of company vehicles, whether it’s for deliveries, transporting goods, or client meetings. Without the right insurance, an accident could lead to significant financial setbacks. Commercial auto insurance provides essential coverage, ensuring that your business is protected from the cost of vehicle repairs, medical bills, and legal expenses resulting from an accident.

What Affects Commercial Auto Insurance Rates?

When shopping for commercial auto insurance, several factors influence the rates you may be offered. These include:

- Vehicle Type: Larger vehicles or specialized equipment may incur higher premiums.

- Driving History: Businesses with a clean driving record are more likely to get lower rates.

- Business Location: Operating in areas with higher traffic or crime rates can impact insurance costs.

- Coverage Options: The more comprehensive the coverage, the higher the premium.

Affordable Commercial Auto Insurance Options for Small Businesses

Insert image of the product

- Progressive Commercial Auto Insurance

Progressive Commercial Auto InsuranceProgressive is well-known for offering competitive rates to small businesses. Their commercial auto insurance policies cover a range of vehicle types, including delivery vans, trucks, and personal cars used for business.- Use Case: Ideal for businesses that require multiple vehicles for operations, such as delivery services or construction companies.

- Pros: Affordable rates, customizable coverage options, and 24/7 customer support.

- Cons: Premiums can increase based on claim history.

- Price: Starts at $75/month for basic coverage.

- Features: Comprehensive and collision coverage, uninsured motorist protection, and roadside assistance.

Insert image of the product

- Nationwide Commercial Auto Insurance

Nationwide Commercial Auto InsuranceNationwide provides a range of insurance products tailored to small businesses, including specialized commercial auto coverage. Their policies cater to various industries, offering customized solutions based on specific needs.- Use Case: Best for businesses with specialized vehicles, such as construction or landscaping companies.

- Pros: Strong financial backing, easy claim process, customizable options.

- Cons: May not be the cheapest for smaller fleets.

- Price: Starts at $80/month.

- Features: Liability coverage, medical payments, and hired auto coverage.

Insert image of the product

- State Farm Commercial Auto Insurance

State Farm Commercial Auto InsuranceState Farm is a trusted name in the insurance industry and provides affordable commercial auto insurance policies. Their large network of agents makes it easy for small business owners to get personalized service and advice.- Use Case: Suitable for businesses that value a strong local presence and personalized customer service.

- Pros: Highly rated customer service, multiple discount opportunities, and a wide agent network.

- Cons: Not the lowest rates available for businesses with large fleets.

- Price: Starts at $90/month.

- Features: Liability, physical damage, and underinsured motorist coverage.

Insert image of the product

- The Hartford Commercial Auto Insurance

The Hartford Commercial Auto InsuranceThe Hartford offers comprehensive auto insurance specifically designed for small businesses. Their coverage options are extensive and can be customized to meet the needs of any small business, from sole proprietorships to larger enterprises.- Use Case: Ideal for businesses that need extensive coverage options and flexibility in their policies.

- Pros: Excellent claims service, customizable policies, strong coverage options.

- Cons: Slightly higher premiums for additional coverage.

- Price: Starts at $85/month.

- Features: Auto liability, physical damage, uninsured motorist, and cargo insurance.

Insert image of the product

- Geico Commercial Auto Insurance

Geico Commercial Auto InsuranceGeico is another popular option for small business owners looking for affordable and reliable commercial auto insurance. With a straightforward online process, Geico makes it easy to get a quote and purchase a policy in minutes.- Use Case: Perfect for small businesses that prefer to manage their insurance needs online with minimal hassle.

- Pros: Low premiums, easy online access, and quick claims process.

- Cons: Limited physical locations for in-person support.

- Price: Starts at $70/month.

- Features: Liability, physical damage, and comprehensive coverage.

How to Get the Best Commercial Auto Insurance Rates

To secure the best commercial auto insurance rates for your small business, follow these steps:

- Compare Quotes: Always request quotes from multiple providers to ensure you’re getting the best deal.

- Bundle Policies: If your business needs other types of insurance, such as general liability or property insurance, bundling them with your auto policy can lead to discounts.

- Maintain a Clean Driving Record: Insurance companies offer lower rates to businesses with no history of accidents or violations.

- Choose the Right Coverage: Evaluate your business’s needs and avoid overpaying for unnecessary coverage.

Where and How to Buy Commercial Auto Insurance

Buying commercial auto insurance is easy and can be done entirely online. Here are the steps:

- Visit the insurance provider’s website (such as Progressive, Geico, or Nationwide).

- Use their online tool to enter your business details and vehicle information.

- Review and compare the quotes provided.

- Select the coverage that best fits your needs.

- Complete the purchase and download your policy documents.

For personalized assistance, you can also reach out to a local insurance agent.

FAQs

- What is commercial auto insurance?

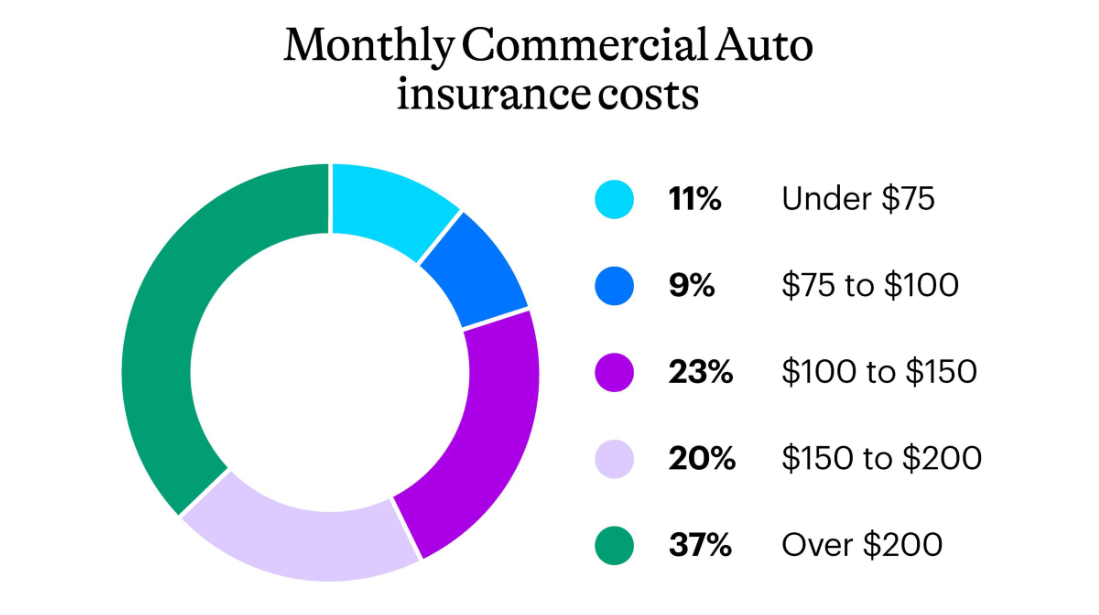

Commercial auto insurance is a policy designed to protect vehicles used for business purposes. It covers liability, physical damage, and medical expenses in the event of an accident. - How much does commercial auto insurance cost?

Rates typically start at $70/month but can vary depending on your business’s size, vehicle type, location, and coverage needs. - Do I need commercial auto insurance if I use my personal car for work?

Yes, personal auto insurance may not cover accidents that occur while using your car for business purposes. Commercial auto insurance provides the necessary protection for work-related activities.